The Solvency II framework are based on the three pillar approach which is somewhat similar to banking regulation of Basel II.

The three pillar approach of Solvency II are:

- Pillar I: Quantitative requirements for measuring financial position and capital adequacy.

- Pillar II: Insurers’ self-assessment of capital needs and capital/risk management processes and procedures subjected to supervisory scrutiny.

- Pillar III: Increased market transparency through greater disclosure and reporting requirements.

(Re)Insurer should know their current solvency ratio, and start identifying key risk indicators (KRIs). Set targets for their reserves and critical business processes. Redefine the role and responsibilities of KRIs owners and establish methodology to measure and control their risks (KRIs).

What is KRIs?

What is KRIs?

KRIs: Key risk indicators (KRI) are measurements that are used by organization to illustrate how risky an activity is.

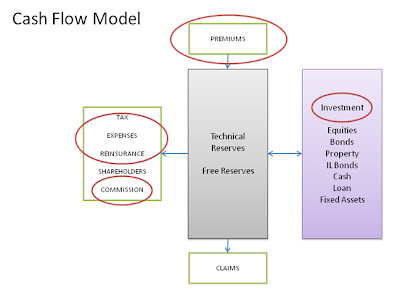

Following figure would able to highlight some of the KRIs focus area.

Following figure would able to highlight some of the KRIs focus area.