- Future Written Premium

- First move is to group business line and product line, so the separate projection of cash flow can be made. Each business lines and product lines have their own assumption and historical data to project the estimated future written premium.

- Future claims

- To get future claims we will separate business line into following parts:

- Catastrophe claims

- Notified claims (incurred but not enough reported - IBNER)

- Incurred but not reported – IBNR

- Claims expected on the existing business

- Claims from the future written business

- Future expenses

- Some of the future claims are easily to calculate because it is simply a function of other assumptions, to make it clearer take an example of compensation paid to agents. It is simply a percentage of insurance products. Claims expense is again based on the extrapolation method to get the future claim expenses. Other expenses such as human resource cost and other are difficult to predict and can be identified by business owner and it is suppose to based on the growth strategy of an insurer.

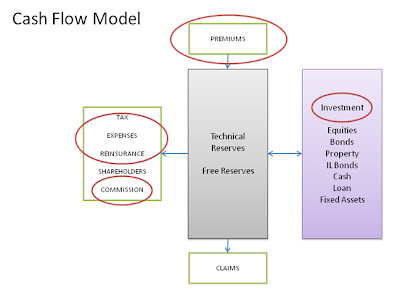

- Future investment Return

- While calculating future investment insurer suppose to consider the market volatility and investment expenses

- Current investment portfolio

- Prospects investment

- Future investment policy of new business written by insurer

- Reinsurance

- Assumptions about reinsurance which we will need to consider:

- Existing agreement

- New agreement may come into picture

- Changes may happen in the existing agreement

- External environment

- We will need to consider interest rate, inflation rate, currency ratio and other economical factor into account and it will be considered to each component of internal model.

Components | Data Needed |

Gross written premium |

|

Reinsurance premium – ceded premium |

|

Gross Claims |

|

Expenses |

|

Investment |

|

Tax and Dividends |

|