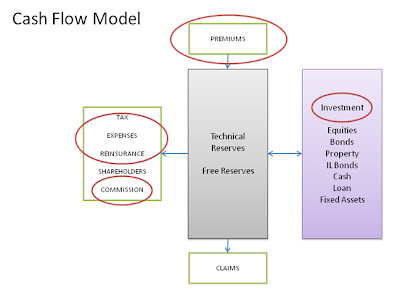

Resources of any company is treated as a capital, so any resources of a company is greater than its liabilities is called net capital available. As per solvency requirement insurer suppose to have excess capital than its liabilities. In fact, it will hold enough capital to insure that it will meet all the obligation of policyholder and beneficiaries to a certain degree of confidence. To obtain that degree of confidence insurer came up with 'capital modeling' concept, this is also known as internal model in the language of solvency II. Internal model help insurer to allocate capital between classes, product and individual policies.

Internal model is based on the cash flow model in which insurer suppose to assess its future business to meet its capital obligation. Therefore a range of assumption will require, including:

- future written premium income

- future claims, on current and future business, and the timing of these claims

- future reserving basis

- future expenses

- investment return

- reinsurance arrangements, costs and recoveries, potential reinsurance exhaustion

- economic variables such as future inflation and interest rates

- likelihood / cost of catastrophes

- the insurance cycle

- operational losses

- tax

- dividends